The Chair of the Senate Appropriations Committee announced that Senator Wiener’s SB 50 is now a two-year bill, which means that it will not be eligible for vote until January. We will continue to track the status of SB 50 and any future amendments or successor legislation that may be introduced.

Senator Wiener’s SB 50 Moves Forward with Compromise Amendments

On April 24, Senator Scott Wiener’s SB 50 passed the Senate Governance and Finance Committee with bipartisan support, incorporating amendments that limit the bill’s scope. It is scheduled to be heard by the Senate Appropriations Committee on May 13. As previously reported, SB 50 mandates a combination of “equitable communities incentives” and a streamlined, ministerial approval process designed to promote housing production for qualifying projects on eligible sites. The amendments are part of a compromise agreement with Senator Mike McGuire and incorporate provisions from his previously competing measure, SB 4.

As amended, SB 50 continues to require that local agencies grant certain “equitable communities incentives” when a project sponsor seeks to construct a residential development that meets specified criteria such as being a “transit-rich” or “jobs-rich” housing project, as defined in the legislation, and complies with tenant protection and other requirements. The incentives limit local agencies’ ability to impose density limits and minimum parking requirements on qualifying projects. For projects within 1/2 or 1/4 mile of a major transit stop, the legislation would also impose minimum height limits of 45′ and 55′ (four to five stories), respectively. The amendments to SB 50 would mandate these incentives only for the state’s largest 15 counties, all with a population of over 600,000. The legislation also exempts certain sites, including those with certain historic designations or that contain existing rental housing, or that are located in a very high fire severity zone or in a coastal zone and in a city with a population of under 50,000.

For counties with populations of 600,000 or less, a qualifying project in a city with a population of over 50,000 and within 1/2 mile of a major transit stop would be eligible for different incentives, including an additional one story above the otherwise allowable height, and relief from maximum density and minimum parking requirements. There are additional exemptions related to historic district and floodplain designations.

As before, the legislation delays implementation for designated “sensitive communities” to allow time for planning efforts directed at affordable multifamily housing.

The legislation would also create a statewide streamlined ministerial process to convert vacant land and homes to multifamily buildings of up to four units. Qualifying conversions could not propose substantial exterior alteration and would be required to meet certain local land use controls such as height, setback, and lot coverage as they existed on July 1, 2019.

SB 50 has a number of co-authors and early supporters, but continues to face opposition from some cities and counties, principally over loss of local land use control, and housing advocates concerned with gentrification and displacement.

Sellers Beware? San Francisco Adopts Community Opportunity to Purchase Act for Multifamily Properties

Owners of multifamily residential properties in San Francisco will soon have to extend purchase offers to certain nonprofit organizations, before making or soliciting offers to sell those properties to anyone else—and will have to give those nonprofits the right to match any offer received from a potential buyer—under new legislation that is poised to become effective in June 2019.

Owners of multifamily residential properties in San Francisco will soon have to extend purchase offers to certain nonprofit organizations, before making or soliciting offers to sell those properties to anyone else—and will have to give those nonprofits the right to match any offer received from a potential buyer—under new legislation that is poised to become effective in June 2019.In the meantime, potential buyers and sellers of multifamily properties should familiarize themselves with COPA’s key provisions, which we covered here, and the applicable timelines, which we’ve illustrated in the downloadable graphic here.

Community Opportunity to Purchase Act

As we explained in a prior post, San Francisco Supervisor Sandra Fewer introduced the Community Opportunity to Purchase Act (COPA) which would give “Qualified Nonprofits,” vetted by the City, both a right of first offer (ROFO) and right of first refusal (ROFR) over multifamily properties. This applies to buildings (existing or under construction) of three or more units, as well as privately owned vacant lots where three or more units could be constructed. On April 23, the Board of Supervisors unanimously approved the legislation, which the Mayor signed on May 3, the last possible day.

What happens now?

Assuming the new legislation goes into effect (barring voter referendum or judicial intervention), it will raise significant legal and practical questions about buyers’ and sellers’ rights and obligations concerning multifamily properties in San Francisco.

After the effective date of June 2, the Mayor’s Office of Housing and Community Development (MOHCD) will have 90 days to promulgate rules to implement COPA. MOHCD must also screen potential Qualified Nonprofits—generally, established organizations that have demonstrated a commitment to and experience in providing housing to lower-income City residents—and following certification, must publish a list of Qualified Nonprofits on its website. The legislation doesn’t give MOHCD a specific deadline to publish an initial list, which will presumably trigger the requirements for sellers to comply with the ROFO/ROFR process.

Although COPA has been hailed by various low-income housing organizations, the San Francisco Apartment Association has stated in public comments that it believes the legislation is “illegal and unconstitutional,” and has indicated it may bring litigation against the City. We will be monitoring any legal developments surrounding the legislation.

What does COPA mean for multifamily transactions?

For multifamily properties that are already in contract to be sold as of COPA’s effective date, the legislation “shall not be construed to impair” any such contract, or to affect property interests held by anyone other than the seller (including existing security interests, options to purchase, or rights of first offer or refusal). However, for buyers and sellers that have engaged in preliminary negotiations but have not entered a formal purchase and sale agreement as of the effective date, these protections may not apply.

COPA appears likely to affect a broad range of transactions in San Francisco, including not just asset sales but also certain corporate transactions and transfers in interests held by trusts. (The Budget and Legislative Analyst’s report to the Board of Supervisors estimated that approximately 112 transactions valued over $5 million may have qualified under the terms of COPA in 2018, although it is unclear how closely this figure lines up with the range of transactions contemplated by the legislation). In very general terms, the most likely immediate effects for sellers of covered properties may be transactional delays, and associated costs, especially as parties adjust to compliance with the new regime. Additionally, sellers may face new liabilities, as COPA confers new private enforcement rights on Qualified Nonprofits and subjects sellers (and parties that have “colluded” with sellers) to monetary damages, possible civil penalties, and attorneys’ fees.

COPA raises a number of significant questions (e.g., what exactly constitutes an “offer,” what is the standard for expressing a “desire to accept,” and in the context of a third-party offer, how to interpret whether it is on “materially different” terms than were offered to Qualified Nonprofits), some of which could be addressed in the MOHCD regulations. The Washington D.C. programs on which COPA has been loosely modeled (the Tenant Opportunity to Purchase Act and District Opportunity to Purchase Act, or TOPA and DOPA respectively) have been the subject of numerous lawsuits and controversy since enactment in 1980. San Francisco’s new legislation may prove to be similarly fraught, and it will be crucial for sellers and buyers to carefully consider the legal aspects of their proposed multifamily transactions as COPA begins to take shape.

The CASA Compact’s Response to the Bay Area Housing Crisis

In 2017, the Metropolitan Transportation Committee (MTC) and the Association of Bay Area Governments (ABAG) mobilized a task force of affordable housing advocates, private developers, local government officials, and other Bay Area leaders and experts to form CASA, or the Committee to House the Bay Area. CASA set out to identify a comprehensive policy response to the region’s housing crisis.

In January of this year, the MTC and ABAG endorsed the CASA Compact, a 15-year plan that prioritizes what it calls the 3 Ps: the production, preservation, and protection of housing in the Bay Area. The Compact calls for the production of 35,000 housing units per year, which would include 14,000 units for lower-income households and 7,000 units for moderate-income households. To encourage production of new units, the Compact supports increasing density for residential projects near transit zones, expediting and streamlining the housing approvals process, and increasing the availability of publicly-owned land for affordable housing development.

The preservation goal is 30,000 affordable units over the next 5 years, including 4,000 units that are identified as at-risk, largely through inclusionary housing fees and long-term affordability covenants.

Housing protection would include protecting 300,000 lower-income households from displacement by mechanisms such as an annual cap on rent increases for the next 15 years, rental assistance and legal aid to low-income tenants, and a uniform “Just Cause Eviction Policy.”

To implement the 3 Ps, the Compact would establish a regional housing entity responsible for financing projects, leasing land for development, and providing technical assistance to local residents and businesses. Funding for the initiatives would come from business, property, and sales taxes, including reforms to the State’s Proposition 13, tax increment funding, and multijurisdictional revenue-sharing agreements.

The State Legislature is considering several bills that have been introduced this year to address the Compact’s priorities. Among them is SB5, or the Local-State Sustainable Investment Incentive Program, which would reallocate $200 million from 2020 to 2025, and $250 million from 2025 to 2029, from each county’s Educational Revenue Augmentation Fund (ERAF) to eligible affordable housing projects. The proposed bill would designate at least half of its funding to streamline development of affordable housing projects that contain at least 50% affordable units through Workforce Housing Opportunity Zones and Housing Sustainability Districts. Other legislation includes SB50, which incentivizes affordable housing development near high-transit zones by providing concessions under the State’s Density Bonus Law and reducing the discretion of local agencies to deny affordable projects.

Battle lines are predictably drawn, with many of the Bay Area’s smaller, suburban communities expressing opposition to the loss of local land use control and perceived disproportionate funding for larger cities. The chairs of the State Legislature’s two housing committees, Assembly Member David Chiu and Senator Scott Wiener, have both indicated a desire to move legislation forward to advance the principles of the Compact.

San Francisco’s Next Big Move in Maintaining Housing Affordability: Nonprofits’ First Right to Purchase Multi-Family Rental Properties

Pending legislation introduced by San Francisco Supervisor Fewer would amend the City’s laws to give certain qualified non-profit organizations certified by the City (“Qualified Nonprofits”) the first right to purchase multi-family rental properties and certain vacant lots in San Francisco.

Highlights are as follows:

- The legislation applies to any residential building with at least three rental units or a vacant lot zoned for at least three units.

- Sellers subject to the new law would be required to notify all Qualified Nonprofits of the intent to sell before putting a qualifying property on the market. Qualified Nonprofits would have five days to respond, triggering an obligation for the seller to provide information about building tenants. Qualified Nonprofits would then have an additional 25 days to make an offer to purchase the building. The seller could reject an offer made, and if no Qualified Nonprofit makes an offer, or if the seller rejects any Qualified Nonprofit offers, the seller could offer the building to the general public.

- If a seller is prepared to accept an offer from a buyer other than a Qualified Nonprofit, then it would be required to give all of the Qualified Nonprofits the right of first refusal on the same terms and conditions and Qualified Nonprofits would have five days to accept or reject that offer (or 30 days if the seller is responding to an unsolicited offer).

- Qualified Nonprofits would have the right to institute a civil action against any non-compliant sellers, with the potential for damages as specified in the legislation.

- The legislation includes protection for existing tenants. It also requires that a property purchased by a Qualified Nonprofit remain rent restricted, meaning that the value of all rents paid in the building could not exceed 80 percent of Area Median Income (AMI) and the gross household income of new tenants could not exceed 120 percent of AMI.

- Certain sales would be excluded, including but not limited to transfers made under a mortgage, deed of trust, or deed in lieu of foreclosure and transfers between certain family members. Seller incentives are also contemplated, which could include a partial City transfer tax exemption, if ultimately adopted by the Board of Supervisors, and federal tax benefits, if available.

Update on SF Planning Department’s Streamlined Review Procedures for Development Projects

In February, the San Francisco Planning Department issued the first quarterly performance report for implementation of its Process Improvements Plan, a program intended to overhaul the project review process. The Plan first took effect in June 2018 in response to an Executive Directive from the Mayor’s Office to reduce approval timelines and remove administrative barriers to housing production. According to the Department’s quarterly progress report, the Department met its deadline for two-thirds of Preliminary Project Applications (PPAs) and 79% of Project Applications, with approximately 48% of projects receiving a Plan Check Letter within 90 days.

The Plan includes two main components. First, for large projects, the Plan shortens the target review time for PPAs from 90 days to 60 days, and requires the Department to provide feedback to developers on the level of review required to obtain approval. Second, the Plan includes a new Project Application, which consolidates the environmental and project information into a single document. The new Project Application requires that project sponsors provide information earlier in the process regarding issues such as historic preservation, hazardous materials, and air quality. The Planning Department expects this to facilitate early scoping of environmental review and entitlements.

The Department is required to make a determination of completeness within 30 days following submittal of a Project Application. Once the Project Application is deemed complete, the Planning Department has 90 days to issue a Plan Check Letter to the developer documenting any open issues. Pursuant to the Executive Directive, the Department must complete a streamlined environmental review of proposed housing projects within specified timeframes after a stable project description has been established. If review under the California Environmental Quality Act (CEQA) is not required, the Department must render an entitlement decision within 6 months. For housing projects, streamlined review for CEQA projects must meet new target timeframes of 9, 12, 18, and 22 months for, respectively, categorical exemptions, negative declarations, Environmental Impact Reports (EIRs), and complex EIRs. The Directive also calls for the issuance of all permits and other post-entitlement approvals required for commencement of construction on large-scale housing development projects within a year after submission of a complete application. The Department expects to launch a new online portal in the spring, which will allow developers to submit the Project Applications, payment, and other materials electronically.

State Agencies Release Land Use and Environmental Considerations for Automated Vehicle Deployment

The state of California is keeping a watchful eye on the potential land use, environmental, and social consequences of automated vehicle deployment. On November 16, 2018, the Governor’s Office of Planning and Research announced the release of “Automated Vehicle Principles for Healthy and Sustainable Communities.” This document involved staff collaboration among state agencies, including the Office of Planning and Research, the Air Resources Board, and Caltrans.

The Automated Vehicle Principles set out several broad guiding considerations that seek to align automated vehicle deployment with other environmental and public policy objectives. The Principles address topics such as encouraging shared use and car-pooling, utilizing low-emission vehicles, promoting efficiency in vehicle size, undertaking efficient land use planning, and addressing transportation equity. These considerations are largely reflective of the research of programs like UC Davis’s 3Revolutions.

While the Automated Vehicle Principles do not impose specific standards and are more likely to serve as a general policy statement for future agency efforts, the statement is nevertheless significant. The Automated Vehicle Principles acknowledge the potential benefits to automated vehicle deployment but warn that the potential consequences could be severe if automated vehicles are deployed without careful consideration of the environmental, land use, and social impacts of the new technologies.

For example, if automated vehicles are deployed as personally owned vehicles, automated technologies could increase vehicle miles traveled since it may reduce disincentives for long commutes. But if automated vehicles are deployed in a manner that is shared, pooled, and properly-sized, then automated vehicles could help reduce vehicle miles traveled.

We expect further and more concrete steps by OPR, CARB, Caltrans, and other state agencies to address the issues raised in the Automated Vehicle Principles, including new policies and proposed legislation. This will likely include measures to encourage cities to incorporate these principles into their land use and transportation planning efforts.

Senator Wiener Introduces Recrafted Legislation Providing Height and Density Bonuses, Other Incentives for “Transit-Rich” and “Jobs-Rich” Projects

Last spring, we reported on Senator Scott Wiener’s SB 827, which proposed major increases in height and density for qualifying housing developments. Battle lines quickly emerged, with supporters claiming that the legislation was a bold, necessary solution to the housing affordability and climate change crises, and opponents asserting that it was a threat to neighborhood stability and an invitation to gentrification. The bill was ultimately killed in Committee. On December 3, Senator Wiener introduced SB 50. Like SB 827, SB 50 would constrain local agencies’ ability to impose height and density limits and minimum parking requirements on residential developments (projects with at least two-thirds of the square footage designated for residential use) that meet the legislation’s “transit rich” and/or “jobs rich” criteria. SB 50 introduces the term “equitable communities incentives” to describe the bill’s various waivers, concessions and incentives.

Senator Wiener added new features, and modified others, to address criticisms of the prior bill. Highlights include:

- Expanding density incentives beyond “transit-rich” projects to “jobs-rich” projects (based on criteria such as proximity to jobs, area median income and quality of public schools) to capture more affluent areas outside major transit corridors.

- Delaying implementation for designated “sensitive communities” (generally, those with a high risk of gentrification or displacement based on indicators such as percentage of tenant population living at or below the poverty line) to allow time for planning efforts directed at affordable multifamily housing.

- Designating properties as ineligible if they have housed tenants in the past 7 years, or if the owner has evicted tenants under the Ellis Act in the past 15 years, prior to submittal of a development application; and

- Providing that projects are generally subject to the more restrictive of SB 50’s affordable housing requirements, or local city inclusionary housing ordinances.

The legislation has a number of co-authors and several early supporters, including Mayors Breed and Schaaf and the State Building Trades Council. It is expected to be opposed by many of the same local communities that resisted SB 827 based on concerns such as loss of local control and gentrification. The bill is currently awaiting Committee referral.

At Long Last: Central SoMa Plan Effective

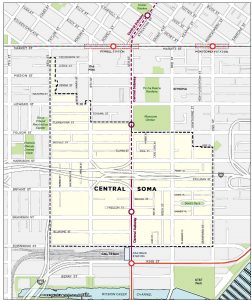

After over seven years of planning and public outreach, as of January 7, 2019, the Central SoMa Plan and its implementing legislation are finally effective. The City’s analysis concludes that the Plan area has development capacity for over 8,000 new housing units (approximately 33 percent of which will be affordable) and over 30,000 new jobs, and will generate over two billion dollars of public benefits.

After over seven years of planning and public outreach, as of January 7, 2019, the Central SoMa Plan and its implementing legislation are finally effective. The City’s analysis concludes that the Plan area has development capacity for over 8,000 new housing units (approximately 33 percent of which will be affordable) and over 30,000 new jobs, and will generate over two billion dollars of public benefits.The key takeaways are as follows:

Rezoning

The Plan area is an approximately 230-acre site that runs roughly from 2nd Street to 6th Street, and from Market Street to Townsend Street, excluding certain areas north of Folsom Street that are part of the Downtown Plan. Very broadly, the Plan and its implementing legislation increase permitted height and density and streamline zoning controls for the majority of the Plan area. With the exception of the Key Development Sites discussed below, height limits in large portions of the Plan area generally increased from 85 feet or less to 130 to 160 feet, subject to bulk controls to encourage building sculpting. In exchange for this upzoning, the Plan requires increased public benefits, including payment of significant development impact fees. See our prior blog post for a summary of other required exactions and public benefits, including privately owned public open space (POPOS) requirements.

The predominant new base zoning district is Central SoMa Mixed Use Office (CMUO), which largely replaces relatively restrictive zoning districts with more flexible mixed-use zoning controls and eliminates Floor Area Ratio (FAR) limits for larger projects that participate in the Central SoMa Mello Roos Community Facilities District (CFD) Program described below. The CMUO zoning district is characterized as an Eastern Neighborhoods Mixed Use District and as such, Planning Code Section 329 Large Project Authorization from the Planning Commission is required for projects that are greater than 85 feet in height or propose the net addition or new construction of more than 50,000 gross square feet. Large Project Authorization is required in addition to any other required entitlements, such as Conditional Use (CU) authorization for, e.g., new hotel uses in the Plan area.

The Plan area is also part of a new Central SoMa Special Use District (SUD), which creates an additional layer of zoning controls. Some of the major SUD controls are: designating the largest sites (over 40,000 square feet) South of Harrison Street as predominantly non-residential; imposing new PDR/Community Building Space requirements on projects with at least 50,000 gross square feet of office space; imposing active ground floor requirements, including requiring “micro-retail” units between 100 and 1,000 square feet for certain projects; imposing renewable electricity requirements; and generally prohibiting new formula retail bar, formula retail restaurant, and standard group housing uses. See new Planning Code Section 249.78 for a complete list of requirements and restrictions in the SUD. Up to 25 feet of additional building height is permitted for certain projects in the SUD that provide certain additional public benefits, including 100 percent affordable housing projects. See new Planning Code Section 263.32.

Again, there is generally no maximum FAR in the Plan area. The purchase of Transfer of Development Rights (TDR) is generally required for larger non-residential projects (50,000 gross square feet or greater) on “Tier C” properties (as defined under Planning Code Section 423.2) for the portion of the project FAR between 3.0:1 and 4.25:1. TDR must be obtained from a Preservation Lot (as defined under new Planning Code Section 128.1) also within the SUD or a lot containing a building with 100 percent affordable housing units.

Key Development Sites

The Plan identifies eight Key Development Sites, which are significantly upzoned, including increased height limits for towers 200 to 400 feet in height (depending on the site), in combination with more permissive Planning Code controls under the SUD and new Planning Code Section 329(e) exceptions, which vary to some extent by site. Key Development Site projects must provide additional Qualified Amenities (as defined in new Planning Code Section 329(e)) and on-site childcare facilities (for office or hotel projects), in addition to the other required public benefits, including payment of substantial development impact fees. There are also special height exceptions for qualifying projects on certain Key Development Sites under new Planning Code Sections 263.33 and 263.34.

Central SoMa Mello Roos CFD

The Central SoMa Mello Roos CFD Program participation requirement under new Planning Code Section 434 applies to projects in the Plan area that include new construction or the net addition of more than 25,000 gross square feet of non-residential development on “Tier B” or “Tier C” properties, or more than 25,000 gross square feet of new residential condo development on “Tier C” properties. See the definitions under new Planning Code Section 423.2. The CFD Program participation requirement is only triggered for projects that also exceed the applicable Prevailing Building Height and Density controls under Planning Code Section 249.78(d)(1)(B), meaning that many smaller projects are exempt.

Legislation for the formation of the CFD was introduced by the Board of Supervisors on December 4, 2018 (BOS File No. 180622).

Central SoMa Housing Sustainability District

The Central SoMa Housing Sustainability District (HSD) encompasses the entire Plan area. As explained in more detail in our prior blog post, residential projects 160 feet in height or less (unless 100 percent affordable) in the HSD meeting specified criteria, including minimum density and affordability requirements, qualify for a 120-day streamlined ministerial (i.e., no CEQA) review and approval process, including design review by the Planning Department.

Qualifying projects first require an informational public hearing followed by Planning Department approval, which will be appealable to the Board of Appeals.

Major BART Housing Bill Passes

On September 30, Governor Brown signed AB 2923, which could pave the way for BART to develop up to approximately 20,000 residential units, plus about 4.5 million square feet of office and commercial uses, on about 250 acres of BART-owned land. It requires cities and counties to adopt local zoning standards for BART-owned land that conform to BART Transit Oriented Development (TOD) zoning standards and establishes a streamlined approval process for qualifying projects. The law sunsets on January 1, 2029.

The new law seeks to ease traffic congestion and increase housing production and affordability by making it easier to develop housing on certain BART-owned land. An eligible TOD project (defined below) qualifies for streamlined ministerial approval (no additional CEQA review) if it meets certain standards related to height, floor area ratio, etc. There are exclusions for projects that have specified adverse, unmitigated environmental impacts.

An “eligible TOD project” is a project at an infill site on BART-owned land with at least 50 percent of the floor area of the project dedicated to residential uses, unless a local specific plan provides for a different amount of residential uses on the site. The site must form a contiguous area of at least 0.25 acres, with at least 75 percent of its area located within one-half mile of an existing or planned BART station entrance. It must also be within an area represented on the BART Board, which excludes areas south of San Francisco. Eligible TOD projects must also meet requirements regarding housing replacement, tenant displacement and relocation, affordable housing, and labor standards.

The law requires the BART Board of Directors to adopt new TOD standards for height, density, parking, and floor area ratio for eligible TOD projects on BART-owned land (TOD Standards) by July 1, 2020. Adoption of the TOD Standards is subject to CEQA review, with BART serving as the lead agency. The minimum TOD Standards are generally set as the 2017 BART TOD Guidelines (TOD Guidelines)—these also apply if BART has not adopted TOD Standards by July 1, 2020. The lowest permitted height is set at the higher of 150% of the height permitted in the TOD Guidelines or the approved height in nearby areas, as defined in the bill. There are also parking requirements for auto-dependent stations and limits on local parking requirements.

Affected local jurisdictions must adopt an ordinance that conforms to the TOD Standards within two years after BART’s adoption of the TOD Standards, or by July 1, 2022 if BART has not adopted TOD Standards for a station. The BART Board is required to review local zoning standards and confirm consistency with the TOD Standards. Certain local provisions are exempt from the TOD Standards if they are already in substantial compliance with the TOD Guidelines. Nothing in the new law affects the application of density bonuses.

AB 2923 was endorsed by the City and County of San Francisco, housing and other non-profit advocacy groups such as the Bay Area Council, SPUR, the Silicon Valley Leadership Group, SFHAC, YIMBY Action, and various building trades and business advocacy groups. The opposition included Alameda County, various East/North Bay cities, three members of the BART Board, the League of California Cities, and the American Planning Association, California Chapter.