UPDATED ON APRIL 22, 2020

On March 19, 2020, Governor Newsom issued a “Safer at Home” Order, which generally permits construction, including housing, to continue statewide. On March 31, 2020, six Bay Area counties – Alameda, Contra Costa, Marin, San Francisco, San Mateo, and Santa Clara – as well as the City of Berkeley, coordinated on and each issued updated local shelter-in-place orders extending and further restricting non-essential activities through May 3, 2020. Among other things, the local orders notably limit the types of construction permitted beyond the State’s Order and require those permissible construction activities to create and implement a “Social Distancing Protocol.”

Most construction, commercial and residential, is restricted under the new local orders. While previous county orders permitted residential construction to continue, the new local orders further limit construction, particularly residential construction, and generally permit only the following types of construction to continue:

- Projects immediately necessary to the maintenance, operation, or repair of Essential Infrastructure;

- Projects associated with Healthcare Operations, including creating or expanding Healthcare Operations, provided that such construction is directly related to the COVID-19 response;

- Affordable housing that is or will be income-restricted, including multi-unit or mixed-use developments containing at least 10% income-restricted units;

- Public works projects if specifically designated as an Essential Governmental Function by the City Administrator in consultation with the Health Officer;

- Shelters and temporary housing, but not including hotels or motels;

- Projects immediately necessary to provide critical noncommercial services to individuals experiencing homelessness, elderly persons, persons who are economically disadvantaged, and persons with special needs;

- Construction necessary to ensure that existing construction sites that must be shut down under this Order are left in a safe and secure manner, but only to the extent necessary to do so; and

- Construction or repair necessary to ensure that residences and buildings containing Essential Businesses are safe, sanitary, or habitable to the extent such construction or repair cannot reasonably be delayed.

While the seven local orders place virtually identical restrictions on construction, other Bay Area counties – Napa, Solano, and Sonoma – impose varying limitations. Sonoma County’s March 31 order is substantially similar to the other local orders, but includes an exemption for construction and debris removal on fire damaged or destroyed properties. Solano County’s March 30 order is generally consistent with the State’s Order. Most recently, Napa County issued a modified order on April 22, 2020 that permits construction (including housing construction) to proceed, so long as contractors follow specific “Construction Site Requirements.”

Different circumstances and considerations could impact how each jurisdiction interprets and regulates its respective order. As an example, San Francisco issued new requirements on April 2, 2020 for contractors to create and implement a Site Specific Health and Safety Plan consistent with designated Best Practices COVID-19 Construction Field Safety Guidelines (in addition to the Social Distancing Protocol), and released further guidance on April 3, 2020 regarding the interpretation of its order. Similarly, Santa Clara County’s FAQ’s state that all construction sites must comply with its COVID-19 Construction Field Safety Guidelines.

Governor Newsom stated at his press conference on April 2, 2020 that he does not intend to apply the more stringent restrictions in the Bay Area’s local orders across the rest of the state at this time. He confirmed that the Bay Area and other counties have the legal right to impose additional restrictions beyond the State’s Order.

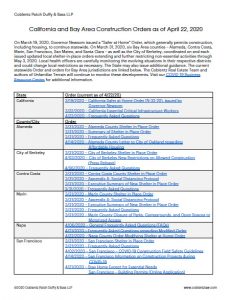

Local health officers are carefully monitoring the evolving situations in their respective districts and could change local restrictions as necessary. The State may also issue additional guidance. The current statewide Order and orders for Bay Area jurisdictions are linked in the chart to the left. The Coblentz Real Estate Team and authors of Unfamiliar Terrain will continue to monitor these developments. Visit our COVID-19 Business Resource Center for additional information.

Local health officers are carefully monitoring the evolving situations in their respective districts and could change local restrictions as necessary. The State may also issue additional guidance. The current statewide Order and orders for Bay Area jurisdictions are linked in the chart to the left. The Coblentz Real Estate Team and authors of Unfamiliar Terrain will continue to monitor these developments. Visit our COVID-19 Business Resource Center for additional information.